In the hours after India’s President Droupadi Murmu granted assent to the‘Promotion and Regulation of Online Gaming Bill, 2025’aka the bill that banned online real money gaming in India, a curious stream of press releases landed in our inboxes.

One section of press releases from gaming startups bemoaned the act, calling it a big blow to India’s gaming industry, while other gaming startups were all-but celebrating it. It epitomises a long-running schism in Indian gaming: the uneasy coexistence of real money gaming on one side, and esports and video games on the other.

The bill, which is yet to be notified in the gazette, is in many ways not just a regulatory clampdown but the formal recognition of a split that has defined India’s gaming industry for years.

The likes of Dream 11, WinZO and others saw their valuations and business evaporate overnight. For the other half, particularly esports companies, video game studios, and developers building entertainment-first products, it is a quiet relief.

The “guilt by association” that shadowed the sector is finally gone, according to industry experts.

For game developers and esports startups, the ban on RMG feels like overdue justice. Real money gaming platforms and casual games were placed under the same regulatory umbrella, treated as one and the same. So much so that online gaming was often used as shorthand for online gambling, especially among critics of RMG.

“The bill provides the esports industry with much-needed legitimacy and clarity. For years, being clubbed with real money gaming meant regulatory risks and made investors overly cautious about esports. But with the demarcation now officially recognised, the industry stands on firmer ground,” Animesh Agarwal, cofounder and CEO of S8UL, said.

Like Agarwal, many believe this conflation was toxic, and that’s perhaps why the game studios and development ecosystem was not about to start mourning the government’s actions.

Every time the Supreme Court or a high court debated the legality of real money or fantasy sports, the broader gaming industry found itself lumped into the same moral and legal debate. Esports organisers worried that sponsors would shy away, fearing reputational damage. Video game studios feared that international publishers would see India as a grey market, best avoided.

And the clarity did not come easy. As far back as 2021, when the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules were introduced, India’s game dev companies and studios began lobbying for a distinction between games of skill for stakes and games built purely for entertainment.

The government’s April 2023 amendments to bring online gaming under the Ministry of Electronics and Information Technology (MeitY) only intensified the debate.

In a rare show of unity, more than 40 video game and esports companies wrote to the government, urging them to reconsider the blanket categorisation. Their submission was unequivocal:

“Video games are fundamentally different from online games played for stakes,” the group argued. “They must be recognised and regulated separately.”

This very clearly drew the line between RMG and gaming studios. One led by the VC-funded fantasy sports apps promising quick riches, and the other driven by developers, artists, and tournament organisers seeking to build India’s answer to global esports franchises and blockbuster video games.

“For years, RMG platforms were also the most powerful lobby in Delhi. With their deep pockets and fast growth, companies like Dream11, MPL, and Games24x7 positioned themselves as the vanguard of India’s gaming revolution. They stressed job creation, tax revenues, and the potential for India to lead globally in skill-based gaming,” founder of a Bengaluru-base AAA gaming studio said.

But critics ranging from state governments to child rights organisations kept pushing back, pointing to addiction, debt, and suicides linked to money-for-stakes play. Juggling legal challenges and state-level bans the RMG brigade took out op-eds, met lawmakers and parliamentary committees, and engaged with regulators in closed-door meetings to get clarity.

Video game companies, meanwhile, fought a quieter battle: convincing policymakers that they were collateral damage in this crossfire. The potential ban on RMG formalises the split that industry insiders had always known existed between two sides.

Road Cleared For Indian EsportsMany in the game development and esports space believe the ban on RMG opens new doors for the rest of the gaming sector.

Global publishers and investors who previously hesitated to enter India now have a clear landscape. They no longer need to worry about reputational risks of being linked to gambling, which could accelerate investments in Indian studios, indie developers, and esports platforms.

“The government’s decision to provide a strong framework for gaming allows us to nurture original IP that represent and reflect our culture. Just like Indian movies act as cultural soft power, Indian games too can rise to that level.,” Deepak Ail, cofounder and CEO of Dot9Games, the creators of FAU-G: Domination, said.

Esports, too, can now position itself more firmly as a mainstream spectator sport, comparable to cricket or football rather than a gambling proxy. Sponsors who once kept the industry at arm’s length may be more willing to sign deals, while policymakers will be freer to craft frameworks tailored to video games and esports — covering intellectual property, age ratings, and online safety , without being dragged into the moral quagmire of gambling.

Equally important is the shift in public perception. Parents, educators, and the general public often conflated gaming with addiction and financial ruin.

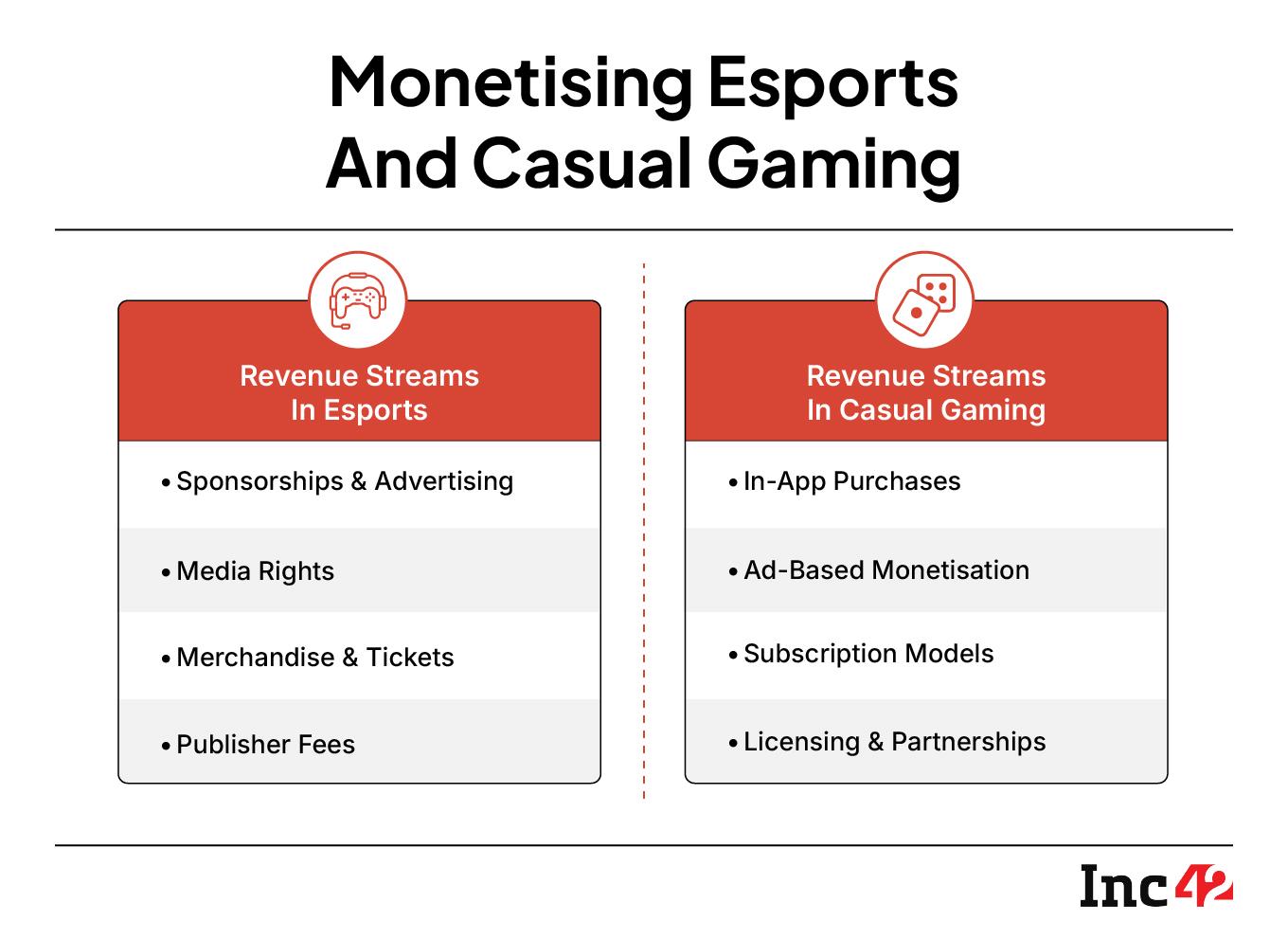

“The new regulation allows us to focus on the ongoing concerns as a business — monetisation, retention, and most importantly, building great IP for India and the world, rather than having to explain to our audiences what we are to begin with,’ added Sumit Batheja, CEO of gaming studio Ginger Games.

Among other changes, the proposed law asks for the creation of an authority to determine which games are real money games and which aren’t. Only the latter will be allowed to launch in the Indian market. The key question is what this certification process might look like — would it be a single-window affair that can be completed online, or does it involve a lengthy approval stage that will harm startups.

The bill also suggests setting up an Indian age-rating mechanism. At present, India follows IARC, the international standard used in most emerging markets.

“In our view, the market here is still too small to justify building an expensive and time-consuming rating system of its own. If certification becomes burdensome, global publishers may choose to skip India altogether, reviving piracy and shrinking revenues. For small Indian studios too, this would mean unnecessary compliance hurdles,” Harish Chengaiah, founder of Outlier Games, said.

Like others in the game dev industry, he believes a more balanced approach would be to continue with IARC while improving consumer protection through awareness campaigns such as teaching parents how to read age labels, and how to use parental controls already available on existing gaming platforms and consoles.

A False Dawn Or Real Hope?These are of course early days and we expect more changes to the contours of the bill and proposed act even after it is notified. These changes could include amendments to the ratings and certification process.

What would be interesting to watch is whether investors flock to the esports corner as many expect. Even after the GST notification of 2023, investors claimed they would be indexing more heavily for game development, gaming communities and esports startups.

But the flow of VC money has not quite picked up momentum even for these sectors which were seen as prime opportunities. Only a handful of companies have been able to raise enough funds to create games that are on par with American, European or Chinese studios.

As we reported in 2023, the lack of access to talent is a major hurdle for game developers and studios. Most animators, visual effects artists, modelers, designers gravitate to the film and TV industry where pay packages are significantly higher than game development.

So while India’s esports and game development startups might be feeling bullish for now, even a law banning real money gaming will not solve these challenges overnight.

[Edited by Nikhil Subramaniam]

The post RMG Ban Widens The Divide Between India’s Gaming Startups appeared first on Inc42 Media.

You may also like

Man Utd transfer news: Kobbie Mainoo issue emerges with Amorim willing to take big loss

'Perfect' BBC period drama based on true story leaves fans begging for more

Plant cuttings are protected from rot and fungal infections if you use this 1 kitchen item

One of world's most dangerous sea creatures washes up in popular holiday spot

Taliban's incredible migrant intervention: 'we are ready and willing' to work with Farage