India’s fintech sector has never been more vibrant, or more competitive. While front-runners like Paytm, PhonePe, Razorpay, and now even Jio Financial Services with its BlackRock JV are consolidating power through massive user bases, deep distribution, and diversified product stacks, companies like MobiKwik find themselves in a difficult and sticky position.

In the first quarter of FY26, MobiKwik posted revenue of INR 281.6 Cr, down 18.6% YoY but up 3.7% from the previous quarter. Losses widened to INR 41.9 Cr from INR 6.6 Cr a year earlier. If the company was in a difficult position before, it’s become even more entrenched in its problems.

“One thing you have to understand is that we’ve been saying repeatedly over the last three quarters that FY25 was, in many ways, the best-positioned year for us,” MobiKwik cofounder and COO Upasana Taku told Inc42.

“But around August, the sentiment towards unsecured lending in India changed sharply, which led to a downturn in the credit distribution system in Q3 and Q4. Now, given that we’ve moved past that politically charged period, it doesn’t make much sense to compare our Q1 FY26 performance on a year-on-year basis, because all the numbers would naturally look worse,” she added.

Taku was referring to the RBI regulations on peer-to-peer (P2P) lending, forcing companies like MobiKwik to shut down or restructure their products like Xtra. MobiKwik also shut down its offering like Zip, which led to a sharp decline in lending revenue and user activity, despite the company’s public statements downplaying the impact.

The COO said that in Q4FY25, the company’s EBITDA was negative INR 45 Cr. By Q1FY26, that number was down to negative INR 31 Cr.

“That’s a INR 15 Cr swing we achieved through very deliberate measures,” she explained. “If we repeat that reduction in Q2 and Q3, we’ll break even by Q2. Even if we fall slightly short, say, INR 10 to INR 12 Cr in savings per quarter, we still expect to turn EBITDA-positive by Q4.”

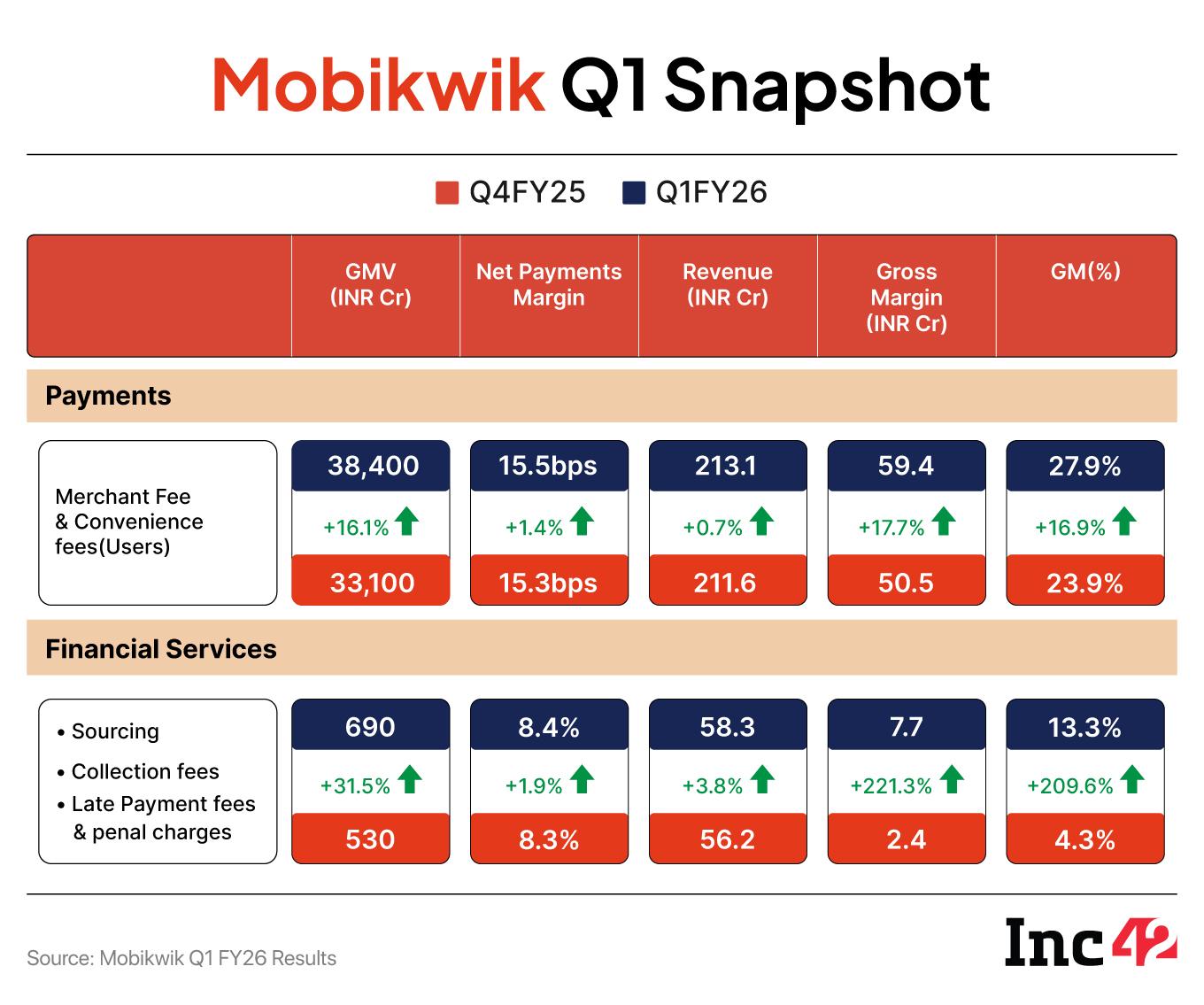

While far stretched, the optimism is not unfounded. MobiKwik posted its highest-ever quarterly payments GMV at INR 38,388 Cr and recorded improvement in gross margins across verticals.

Taku’s hopes for profitability are based on Mobikwik’s payment business, which she says has the highest contribution margin of 28%, compared to other payments companies in India. It is pertinent to note that Paytm had reported a contribution margin of 60% in the same period.

According to her, for every INR 100 spent by a user, Mobikwik generates 15 basis points in net payment margin. That’s five times more than the most profitable players in the space, she says.

However, even after all this, where does MobiKwik stand in the highly competitive space of the Indian fintech market? While claiming 5X of the net payment margin, Mobikwik’s Q1 revenue remains 7% of Paytm’s and is dwarfed by PhonePe and Razorpay’s annual run rate.

For context, Paytm declared a net profit of INR 123 Cr on INR 1,586 Cr in Q1 FY26 revenue, while in FY24, PhonPe reported an income of INR 5,064 Cr. With this framing, MobiKwik positions itself not as a market leader, but it’s not a new entrant by any means.

Scaling Without Scale: Will New Bets Work Out?MobiKwik’s core payments business is the company’s financial backbone. This performance is underpinned by growing UPI adoption and a recalibrated cost structure, including lower gateway charges and improved routing logic. The company has also leaned into its digital wallet offering, claiming a 20% market share in India’s prepaid wallet space with around 36 Mn monthly active users.

Notably wallets, long considered declining, are seeing a second wind as interchange fees and wallet-on-UPI interoperability begin to kick in. While UPI accounts for 25 times more usage than wallets, the wallets become more important for the fintech companies as they are currently the only source of revenue in the direct payment business.

As of Q1 FY26, the company had a registered user base of 180.2 Mn. MobiKwik has also rebranded its offering as Pocket UPI and now allows wallet-based payments on any UPI QR code, a strategic move to tap into the country’s 100 Mn plus QR merchant base.

“A good chunk of our overall business and GMV comes from the wallet, and we are able to monetise the wallet now,” said Taku. “We have been the largest wallet player in India for the past 12-plus months. Our market share typically fluctuates between 20% to 24%. Other players in the ecosystem, whether it’s PhonePe, Cred, Amazon, or others, also have wallet offerings, but their market share tends to hover in the 4% to 5% range,” she further explained.

However, with all these, the company’s payments revenue for the quarter is still at INR 68 Cr, which is really low compared to industry peers. Paytm’s payments revenue, for instance, was INR 529 Cr in the same quarter.

Similarly, the lending business is another front where MobiKwik has been investing its time now, especially after the closure of the BNPL format. In the quarter, the company disbursed INR 693 Cr in loans, all under its longer-tenure Zip EMI product.

“All loans are under the Digital Lending Guidelines (DLG), with maximum loss capped at 5%,” said Taku, who added that the lending vertical delivered 13.3% gross margin in the quarter. But once again, the size tells its own story. Paytm disbursed loans to 5.6 Lakh users in just this quarter alone.

And now, the company is also foraying into stock broking, launched in July 2025 through its subsidiary MobiKwik Securities Broking. According to Taku, it’ll not focus on user acquisition from Tier I cities, where the likes of Groww and Zerodha have already a dominance, but it’ll focus on Bharat.

“We are not trying to acquire users from other platforms… We are trying to capitalise on the net new user who is going to first discover an app like MobiKwik for payment, and then… satisfy them on all their financial schemes,” claimed Taku.

This mirrors the approach Jio Financial Services is attempting but without the latter’s muscle in distribution, funding, or brand familiarity.

It is an ambitious goal, but MobiKwik enters a space dominated by giants. Groww and Zerodha control nearly 21 Mn active investors between them, backed by trusted platforms, low pricing, and deep product ecosystems. Jio, with its telecom-based reach and partnership with BlackRock, is only beginning its assault on the same market.

MobiKwik Rides The Shifting TidesFor MobiKwik to gain meaningful traction in financial services, it must contend with shifting user behaviour, tightening regulatory oversight, and an intensifying pricing war that it may not be well capitalised to endure. Notably, the company has only about INR 300 Cr from its IPO proceeds and it’s too little to position itself as a significant player in the market.

And again, a central challenge remains unanswered: why would a user choose MobiKwik’s offering over more established alternatives?

Taku however, frames the opportunity not in terms of competing with existing financial platforms, but in addressing the large, underpenetrated segment of digital payment users who have yet to explore investment or credit products.

“While over 450 Mn Indians actively transact digitally, only a fraction, roughly 70 to 80 Mn, engage with services like stock trading, lending, or mutual fund investments,” she says.

MobiKwik’s strategy, according to her, is to target these net new users: individuals who first discover the app for payments and can then be introduced to financial products before they migrate elsewhere. The vision is to serve these users end to end, offering mutual funds, equities, fixed deposits, and gold investments, all within a single, unified platform.

Efficiency Isn’t Enough, But It’s A StartWhere MobiKwik deserves genuine credit is in its operational tightening. Direct costs in both payments and lending have come down. Fixed costs have held steady between INR 104 Cr to INR 108 Cr for five straight quarters.

Employee benefit expenses too have declined slightly. “We are being more optimal,” explained Taku. “Automation and AI will definitely play a role… We are using AI for smart coding, collections optimisation, and customer support resolution.”

The company now uses AI-assisted engineering and smarter routing infrastructure in payments, while collections and customer queries are also aided by AI. However, while these are sensible moves, they are unlikely to be game-changers at MobiKwik’s current scale and would be unlikely to provide the significant turnaround that Paytm was able to achieve.

However, one thing where MobiKwik can actually save a lot of expenses is payment gateway charges. As of Q1, half of the company’s expenses were directed towards these charges. MobiKwik’s ZaakPay already got the payment aggregator license in May this year. The company says that it’ll soon incorporate that into the company’s internal operations as well as provide the offering to other businesses as well.

However, still, MobiKwik finds itself at a crucial junction. It is no longer a startup sprinting to prove product-market fit, but neither is it a heavyweight that can influence market direction. It sits in that middle tier, technologically competent, and working hard to deepen monetisation of a relatively modest user base.

The path ahead is difficult. Every segment it operates in, payments, lending, UPI, wallets, and broking, is defined by dominant incumbents. For now, as Taku rightly summarised, “We are trying to improve on the EBITDA side, while trying to grow on the top line.” Whether that balance is enough to propel MobiKwik into the top tier of Indian fintech remains to be seen.

The post MobiKwik’s Uphill Climb Gets Even Steeper appeared first on Inc42 Media.

You may also like

UAE launches national programme to train Emiratis in space mission design and satellite engineering

Sprouts Recipe Ideas: Be it lunch or office tiffin, make these recipes

Boden shoppers are loving this 60% off 'staple' jacket in the summer sale

Two cruise ship tourists killed as gales batter Greece

Tesco shoppers are rushing to try new seasonal coffees that cost just 42p each